Mobile Banking

NSBANK Mobile App Service Details-:

|

1)Enquiries Bank) IFSC (Outside Bank)

4) Manage Payee outside bank). |

5)Other services:

8) Help 9) Forgot MPIN 10) Change Pin (login PIN and Transaction PIN Both) |

How to register and activate Mobile Banking Service:

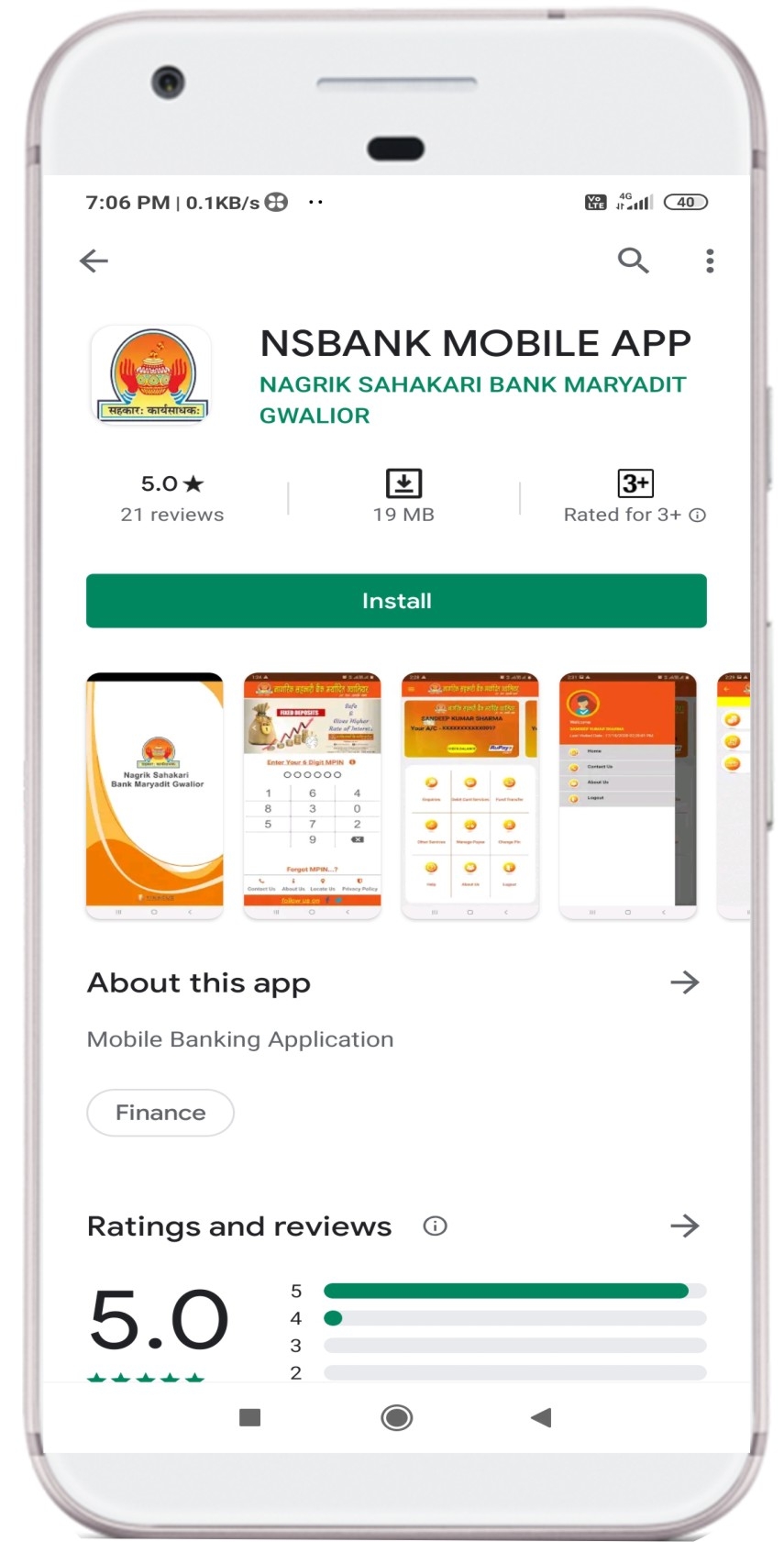

- Download NSBANK Mobile App on your Mobile from Play Store or Our Bank Website.

- Install app using mobile number which is registered in your Nagrik Bank Account.

- Enter your debit card details and after some time you will get SMS for MPIN and TPIN.

- Change your MPIN and TPIN accordingly.

- Enter your MPIN

- After that you can use NSBANK Mobile App services.

Benifites of USing MoBILE BANKING

- Customer doesn’t have to wait in line.

- Customer don't have to plan them day around the bank's hours.

- Customer can look at them balance whenever they want, not just when they get a statement

- Customer can check them account Transaction details quickly

- This Service give you notified of suspicious activity

GUIDELINE FOR CUSTOMER

Obtain application form for IMPS Service or Download application from our web site or Play Store Register yourself by verify your Mobile Number and entering debit card details. After successful registration, SMS will be sent to mobile with details of MPIN and TPIN. Kindly change your MPIN and TPIN accordingly.

FORGOTTEN MPIN

Reset your MPIN by Forgot MPIN option of NSBANK Mobile App .

FAQ(Frequently Asked Question)

FAQ (FREQUENTLY ASKED QUESTION)

What is IMPS?

Interbank Mobile Payment Service (IMPS) is an instant interbank electronic fund transfer service through mobile phones. IMPS facilitate customers to use mobile instruments as a channel for accessing their banks accounts and remitting funds there from.

Who is providing IMPS service?

NPCI National Payment Corporation of India is providing IMPS service.

Are all banks offering IMPS?

The updated list of banks offering IMPS will be available in NPCI website www.npci.org.in.

Does the customer need to have a bank account for availing IMPS?

Yes, the customer needs to have a bank account with the bank which has enabled this facility.

Does the customer need to register to remit the funds through IMPS?

Yes. Customer should enrol for Mobile Banking Service with the bank where customer has an account. The registration process shall be as per their bank’s laid down procedures.

Can a customer link more than one account to the same mobile number?

Yes. The customer can link the same mobile number to more than one account subject to bank offering that feasibility.

How can I receive money using IMPS?

P2A (Person to Account)

• Share your Account Number and your Branch IFSC Code with the remitter

• Ask the remitter to send money using your Account Number and IFSC Code

• Check the confirmation SMS for credit to your account from the remitter

Is there any limit on the value of transactions in IMPS?

The limit is defined by RBI in the Mobile Payment Guidelines issued to banks. The customer can transact on IMPS subject to a daily cap of Rs. 50,000/- per customer overall for transactions through mobile for the funds transfer.

What are the timings for initiating and receiving IMPS remittances?

IMPS transactions can be sent and received at any time and any day. There are no timing or holiday restrictions on IMPS remittances.

What are the charges for the customer for sending and receiving remittances using IMPS?

Please see service charges on website.

Are there any subscription charges for the customers to avail this facility?

No Charges. Free Service

How long does it take for the remittance to get credited into the beneficiary account number?

The funds should be credited into the beneficiary account in about 15-30 seconds.

Can the remitter transfer funds from his / her to the beneficiary account in other bank?

Yes, the remitting customer can transfer funds to the beneficiary account in other banks.

Is it necessary to have sufficient account balance to initiate a remittance?

Yes, the customer should have sufficient account balance to initiate a fund transfer.

Is it necessary to have a minimum balance to receive funds through IMPS?

Not necessary.

How does the remitter come to know that his account is debited and funds have been credited in the beneficiary’s account?

The remitting bank sends a confirmation SMS to the remitting customer about the transaction initiated by him / her.

How does a beneficiary come to know of funds being credited to his / her banks account?

The beneficiary bank sends a confirmation SMS to the beneficiary customer informing him / her of the credit in the account.

When can the beneficiary use the funds received through IMPS?

The beneficiary can use the funds immediately on receipt of credit in the account. The funds received through IMPS are good funds and can be used immediately upon credit.

HOW TO GET MPIN anD TPIN?

The following steps should be followed to get MPIN and TPIN-

- Download NSBANK Mobile App on your Mobile from Play Store.

- Install app using mobile number which is registered in your Nagrik Bank Account.

- Enter your debit card detail and after some time you will get SMS for MPIN and TPIN.

- Change your MPIN and TPIN accordingly.

HOW TO RECEIVE FUND?

P2A (Person to Account)

- Share your Account Number and your Branch IFSC Code with the remitter

- Ask the remitter to send money using your Account Number and IFSC Code

- Check the confirmation SMS for credit to your account from the remitter

What is Mobile Binding/linking?

In Mobile Binding/ linking, your mobile device credentials like serial number, IMEI number are linked with the mobile app to make your ATM Card access secured. This limits access to Mobile App from a trusted Mobile only and makes your app usage secure.

*During Mobile binding the registered number SIM card should be in Mobile and it have sufficient balance for Incoming/Outgoing services and SMS.

I have changed my mobile number during IT System upgrade period, what do I do to register my new mobile number?

You have to first deregister your old mobile number through branch and register your new mobile number afresh.

How secure is NSBANK Mobile app?

Application is fully secure with the following security features:

- 2-factor MPIN and TPIN authentication

- Device/SIM Binding with handset IMEI number.

- System validates customer Mobile Number, Device IMEI number and SIM serial number at the time of login.

What are the Service Charges for using NSBANK Mobile app?

At present, Nagrik Sahakari Bank Maryadit Gwalior is offering this facility absolutely FREE. To use NSBANK Mobile App, you pay SMS sent during the activation of the application, as per their tariff plan with your service provider.